40 unemployment tax form

Authorization for Tax Withholding (Form 1040WH)This document is used by unemployment insurance claimants to authorize the withholding of taxes from their unemployment insurance benefit payments. Business Change in Status (Form 013) Use this form to update business status such as entity changes, ownership changes, name changes, etc. Information for tax year 2020 is now available. Unemployment compensation is taxable income and must be reported each year even if you have repaid some or all of the benefits received. The 1099-G form is used to report taxable benefits when filing with the IRS for anyone who was paid unemployment benefits or Alternative Trade Adjustment ...

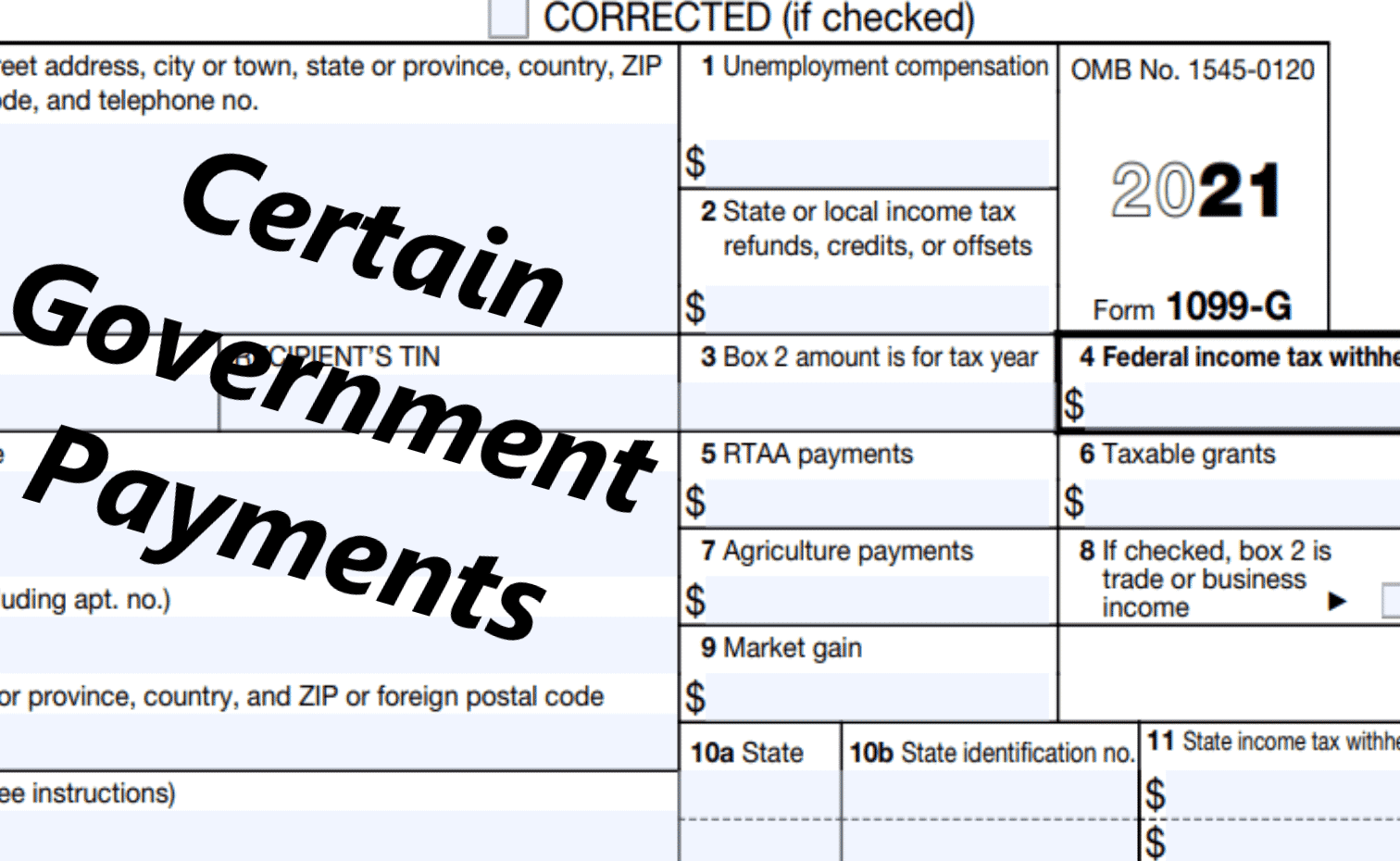

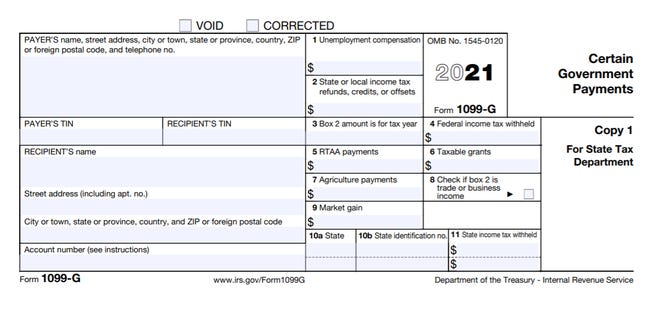

The Form 1099-G reports the total taxable unemployment benefits paid to you from the Tennessee Department of Labor & Workforce Development for a calendar year and the federal income tax withheld, if applicable. Your benefits are taxable and reportable on your federal return, but you do not need to attach a copy of the Form 1099-G to your ...

Unemployment tax form

2020 Individual Income Tax Information for Unemployment Insurance Recipients. Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS. As taxable income, these payments must be reported on your state and federal tax return. Total taxable unemployment compensation includes the new federal programs ... Taxes, deductions, and tax forms (1099-G) for unemployment benefits You're responsible for paying federal and state income taxes on the unemployment benefits you receive. The Department of Unemployment Assistance (DUA) does not automatically withhold taxes, but you may request that taxes be withheld from your weekly benefits when you file ... If you are married, each spouse receiving unemployment compensation doesn't have to pay tax on unemployment compensation of up to $10,200. Amounts over $10,200 for each individual are still taxable. If your modified AGI is $150,000 or more, you can't exclude any unemployment compensation.

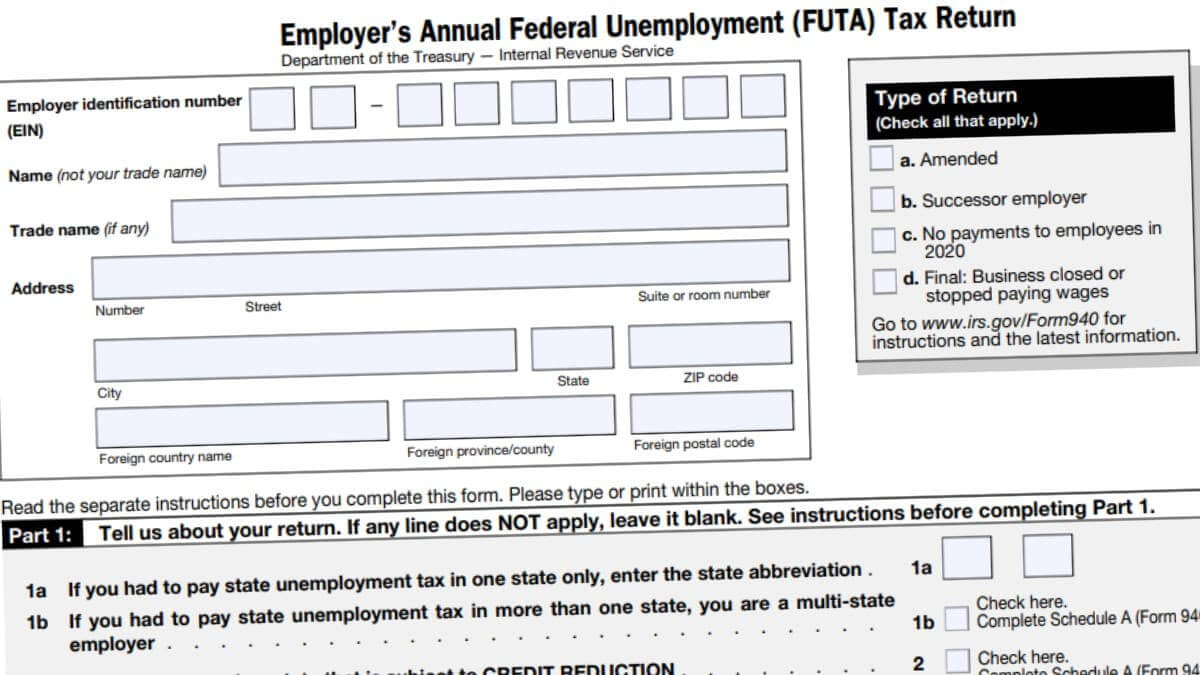

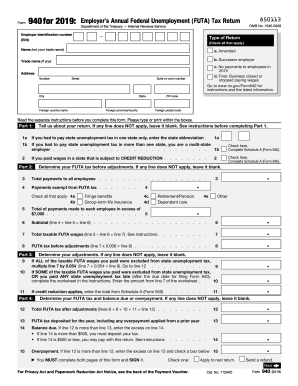

Unemployment tax form. File Wage Reports & Pay Your Unemployment Taxes Online. Use our free online service to file wage reports, pay unemployment taxes, view your unemployment tax account information (e.g., statement of account, chargeback details, tax rate), and adjust previously filed wage reports. File wage reports, pay taxes & more at Unemployment Tax Services. Use the forms below to register or update your unemployment tax account: Employer's Registration - Status Report - (Form C-1) enables TWC to establish a new account for a non-farm employer. Print this form and mail it in or register online.; Farm & Ranch Employment Registration - Status Report - (Form C-1FR) enables TWC to establish a new account for a Farm or Ranch employer. What is the IRS Form 1099-G for unemployment benefits? By Jan. 31, 2021, all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security. 1099-G forms are delivered by email or mail and are also available through a claimant's DES online account. Tax Form 1099-G Issues. The Colorado Department of Labor and Employment provides Form 1099-G documents to claimants detailing the amount of unemployment benefits the claimant has been paid during the year. Some 1099-G documents provided to claimants both electronically and by mail in January 2021 included an incorrect Taxpayer Identification ...

You are responsible for paying any required federal taxes on any unemployment compensation payments you received in 2020, including these new COVID-19 related programs, in 2020. For example: If you received 35 weeks of the maximum benefits ($713 x 35) in 2020, plus FPUC (17 weeks x $600), plus FEMA/LWA (6 weeks x $300), your Form 1099-G will ... The Tax Department issues New York State Form 1099-G. This form does not include unemployment compensation.. If you received unemployment compensation in 2020, including any income taxes withheld, visit the New York State Department of Labor's website for Form 1099-G. The Internal Review Service (IRS) requires that Form PUA-1099G be provided to unemployment compensation recipients who were paid Pandemic Unemployment Assistance (PUA) benefits, during the prior year. This statement shows the total or gross amount of PUA benefits received and the amount of federal tax withheld, if any. Unemployment Compensation Tax Reporting Related Forms The Contribution Section processes forms and correspondence via an electronic imaging system. Your documents are scanned, converted to an optical image, and then processed by an automated workflow system. Please

The Statement for Recipients of Certain Government Payments (1099-G) tax forms are now available for New Yorkers who received unemployment benefits in calendar year 2020. This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2020, as well as any adjustments or tax withholding made to your benefits. Form 1099G reports the total taxable income we issue you in a calendar year, and is reported to the IRS. As taxable income, these payments must be reported on your federal tax return, but they are exempt from California state income tax. Total taxable unemployment compensation includes: Unemployment Insurance (UI) benefits, including: The 1099-G is a tax form for Certain Government Payments.ESD sends 1099-G forms for two main types of benefits: unemployment and family leave.. Unemployment benefits. Every January, we send a 1099-G form to people who received unemployment benefits during the prior calendar year. Form 1099-G details how much unemployment benefits a claimant received during the calendar year as well as information about taxes withheld from their benefits. This information must be reported each year for tax purposes. The forms are also available for years 2016-2018.

Log on using your username and password, then go to the "Unemployment Services" menu to access your 1099-G tax forms.If you have questions about your user name and password, see our frequently asked questions for accessing online benefit services.. After you are logged in, you can also request or discontinue federal and state income tax withholding from each unemployment benefit payment.

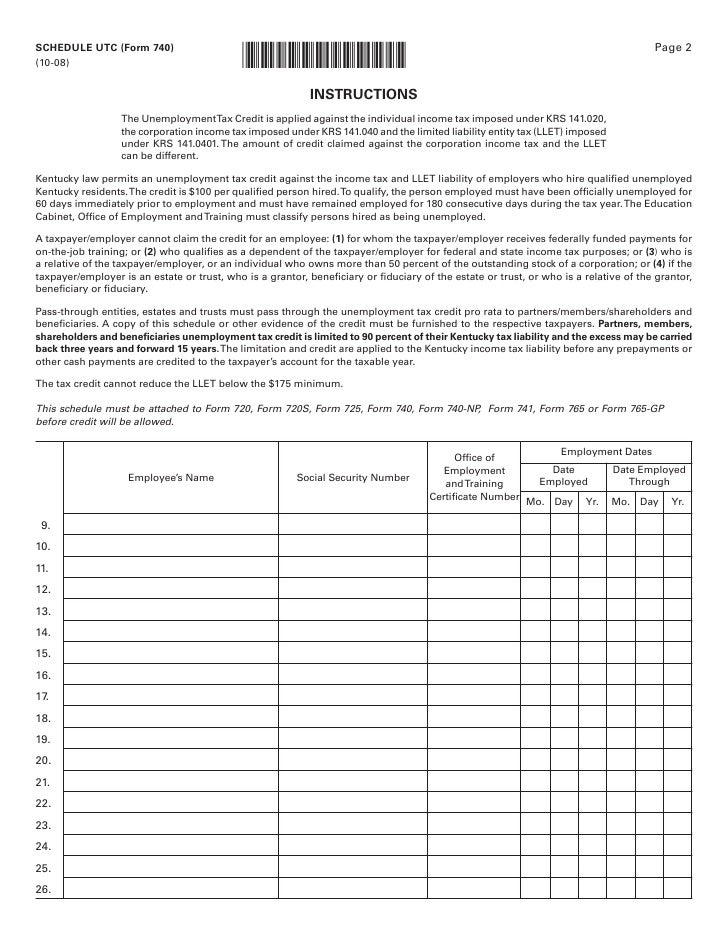

Unemployment Tax Wage Report (UC-018) - Use this form to report the number of full and part-time covered workers for a quarterly period and the quarterly tax due. The UC-20, Wage Continuation form is incorporated into form UC-018. It is used to report employee wages paid during the report quarter (submit with the Unemployment Tax and Wage ...

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

On January 28, 2021, the Arizona Department of Economic Security (DES) began mailing 1099-G tax forms to claimants who received unemployment benefits in the state of Arizona in 2020. Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form.

1099-G Tax Form. The 1099-G tax form is commonly used to report unemployment compensation. Instructions for the form can be found on the IRS website.

Please click on the links below to see the corresponding PDF form. SF-50: Federal Civilian Employee Notification of Personnel Action (PDF) SF-8: Unemployment Compensation for Federal Employees Program, Notice to Federal Employee About Unemployment Insurance (PDF) 1040-ES: Tax Withholding (PDF)

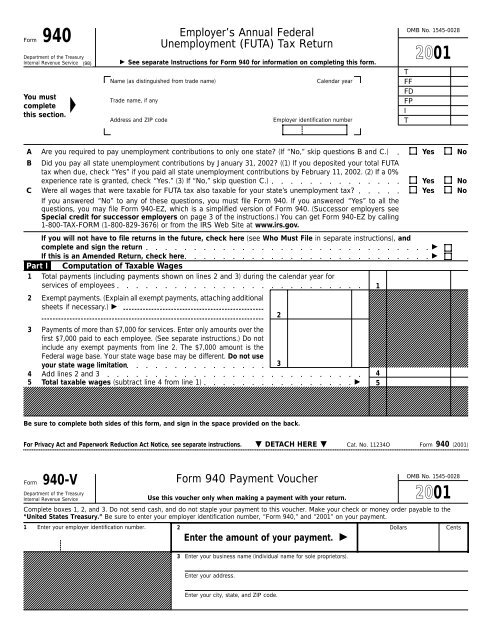

Employers that are liable for Missouri unemployment tax contributions must provide the Division of Employment Security (DES) information on the wages of their covered employees each quarter. Individual workers' wages are recorded on the DES wage record files and retained for five quarters to be used for determining monetary benefit entitlement should a worker file a claim for unemployment ...

Reporting Unemployment Compensation. You should receive a Form 1099-G, Certain Government Payments showing the amount of unemployment compensation paid to you during the year in Box 1, and any federal income tax withheld in Box 4. Report the amount shown in Box 1 on line 7 of Schedule 1, (Form 1040), Additional Income and Adjustments to Income ...

Taxpayers who receive unemployment compensation are encouraged to watch their mailboxes during the tax season for the 1099G tax form that is required to file your federal tax returns. Although unemployment compensation is not taxable for Pennsylvania personal income tax purposes, this form will be an important part of preparing your tax returns.

The 1099-G is an IRS form that shows the total unemployment benefits you received and any taxes withheld during the previous calendar year. You will need this information when you file your tax return. The Department of Unemployment Assistance (DUA) will mail you a copy of your 1099-G by Jan. 31 of ...

Enter the amount from Box 1 on Line 19 ("Unemployment Compensation") of your 1040 form. If you have more than one 1099-G form, add all the amounts from Box 1 on each form, and enter the total amount on Line 19 of your 1040 form. Denise Caldwell is a finance writer who has been writing on taxation and finance since 2006.

Fillable Online Irs Form 940 Ez Employer S Annual Federal Unemployment Futa Tax Return Irs Fax Email Print Pdffiller

If you are married, each spouse receiving unemployment compensation doesn't have to pay tax on unemployment compensation of up to $10,200. Amounts over $10,200 for each individual are still taxable. If your modified AGI is $150,000 or more, you can't exclude any unemployment compensation.

Taxes, deductions, and tax forms (1099-G) for unemployment benefits You're responsible for paying federal and state income taxes on the unemployment benefits you receive. The Department of Unemployment Assistance (DUA) does not automatically withhold taxes, but you may request that taxes be withheld from your weekly benefits when you file ...

2020 Individual Income Tax Information for Unemployment Insurance Recipients. Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS. As taxable income, these payments must be reported on your state and federal tax return. Total taxable unemployment compensation includes the new federal programs ...

Illinois Unemployment If You Got A 1099 G Tax Form From Ides Without Filing For Benefits You May Be Victim Of Fraud Abc7 Chicago

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

0 Response to "40 unemployment tax form"

Post a Comment